KAIST

BREAKTHROUGHS

Research Webzine of the KAIST College of Engineering since 2014

Spring 2025 Vol. 24Enhancing sustainability of the National Pension Service by investing in population growth

Enhancing sustainability of the National Pension Service by investing in population growth

Investing in population growth can enhance the sustainability of the National Pension Service.

Article | Fall 2015

The size of the National Pension Fund is currently 500 trillion won, which is larger than that of the annual government budget of South Korea. Moreover, the National Pension Fund is expected to grow to 2.5 quadrillion won by 2043, which would be approximately a half of the nation’s GDP.

Unfortunately, the fund will begin posting a deficit in 2044 and will be depleted by 2060. Even worse, the estimated amount of deficit in 2060 is 500 trillion won, which will increase significantly every year. Without a question, the sustainability of the National Pension Service (NPS) is being severely challenged, which ultimately threatens the social security of the nation.

The conventional suggestions to enhance its sustainability are 1) to increase contribution, 2) to decrease benefits, or 3) to improve investment return for the pension fund. However, each of these have drawbacks. 1) and 2) are not easy to implement, and 3) comes at a price: increased risk.

KAIST Professor Woo Chang Kim has proposed a completely new approach, which could potentially prevent the National Pension Fund from running out. He argues that the NPS will not reach the point of deficit if it invests directly in population growth to increase the birth rate to a certain level.

More specifically, if the NPS invests about 1 percent of its outstanding fund a year toward population growth, and if there are more than 0.4 birth per 10 million won (1 birth per 25 million won), there will be no depletion of the pension fund at all. This is equivalent to investing to a financial instrument whose annual return is 8.3% per annum. Note that the target annual return of NPS is about 5.5%.

The biggest implication of this study is that it quantitatively illustrates that 1) it is suboptimal for large pension plans to invest only in financial markets and 2) a pension plan’s sustainability can be greatly improved by investing in the society. There have been many researchers who argued similarly, but Professor Kim’s study is the first one that provides concrete mathematical and empirical evidence.

Most Popular

When and why do graph neural networks become powerful?

Read more

Smart Warnings: LLM-enabled personalized driver assistance

Read more

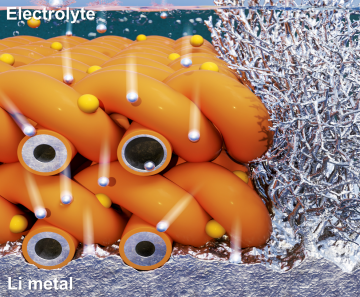

Extending the lifespan of next-generation lithium metal batteries with water

Read more

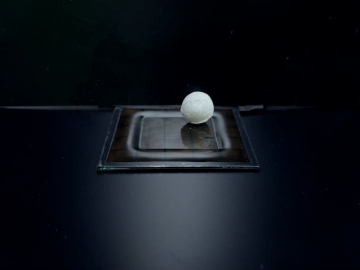

Professor Ki-Uk Kyung’s research team develops soft shape-morphing actuator capable of rapid 3D transformations

Read more

Oxynizer: Non-electric oxygen generator for developing countries

Read more